What Will Your Legacy Be?

Perhaps you have been thinking about what’s important in your life and how you can make a lasting impact on the future of the Dominican Friars and those who will benefit from their preaching.

Your prayerful support reflects the priorities and values you cherish and supports our mission of preaching Jesus Christ and His Saving Gospel. It funds one of the fastest growing Catholic men’s religious communities in the United States and helps restore the unity of faith and reason in our society. A gift left to the Dominican Friars in your estate plan is a way to ensure that the faith and values you hold dear will live on for generations to come.

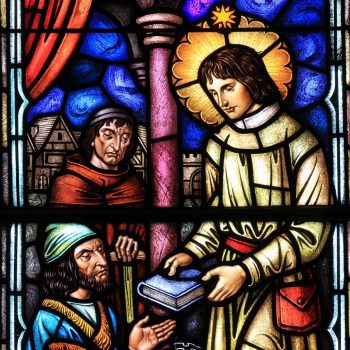

We invite you to join us, by aligning your own legacy of faith with that of the 800 year Dominican legacy.